How the Fed Rate Cut Will Impact Singapore Property in 2025–2026

How the Fed’s Latest Rate Cut Impacts Singapore Property: What New-Launch Buyers, Resale Buyers, Homeowners & Investors Must Do Now (2025–2026 Guide)**

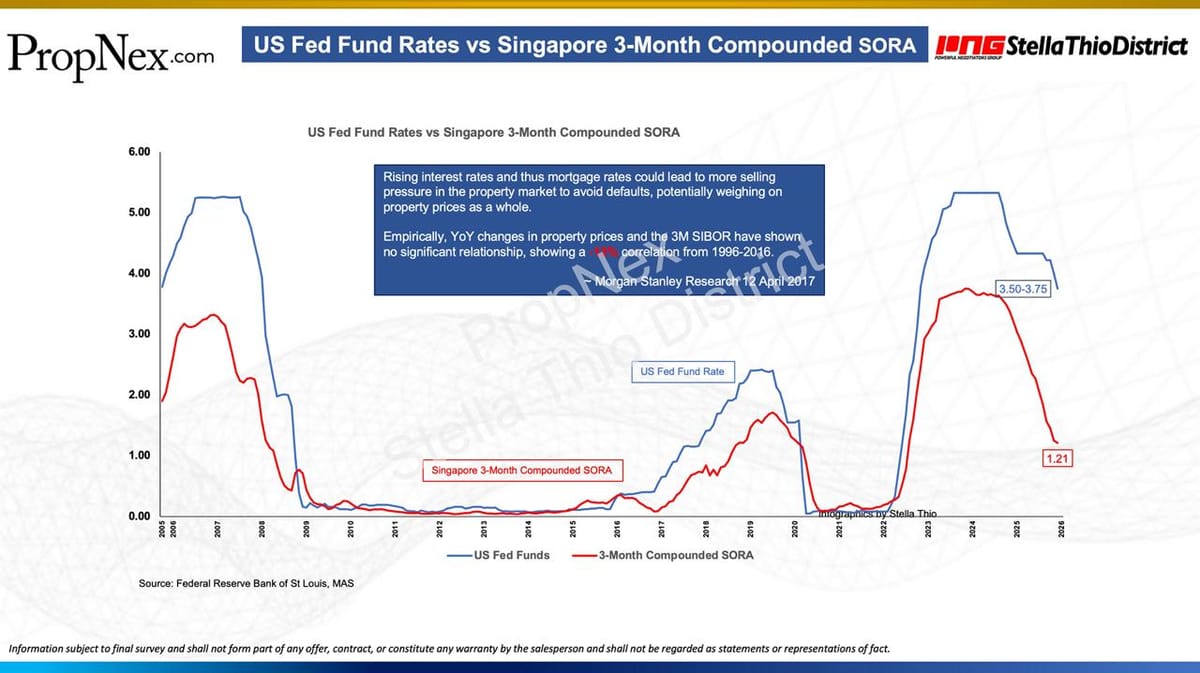

The U.S. Federal Reserve has delivered a widely expected 25-basis-point rate cut, lowering the federal funds target range to 3.50–3.75%.

As of 11 December, Singapore’s SORA stands at 1.0377%, with the 3-month compounded SORA at 1.21%, the benchmark for most Singapore mortgages.

While nine FOMC members supported this latest cut, two argued to maintain rates, and Governor Stephen Miran pushed for a steeper 50-basis-point reduction. Forward guidance now points to one more cut in 2026 and another in 2027, although Miran has floated a more aggressive scenario of six additional cuts, which would push rates to 2.50–2.25%.

At the same meeting, the Fed instructed the New York Fed to begin Reserve Management Purchases (RMPs)—roughly USD 40 billion monthly from December 2025 to April 2026. Although branded as reserve management, this essentially marks the restart of Quantitative Easing, ahead of a new Fed Chair taking office in May 2026.

Despite the scale of these measures, markets have reacted cautiously.

- Core inflation sits at 2.8%, still above the Fed’s 2% target.

- The Fed is supporting the depleted Overnight Reverse Repo (ON RRP) facility—a sign of tightening bank reserves and a step often viewed as a precursor to debt monetisation.

After decades of heavy debt issuance by the U.S. and Japan, the global economy is shifting into a new monetary era: one where central banks cannot hike rates aggressively without straining government budgets, reducing their ability to fight inflation in a conventional manner.

So what does this mean for Singapore’s property market—and more importantly, for you as a buyer, owner, or investor?

Impact on Singapore Property Market: What Different Groups Must Know

1. New-Launch Buyers: Prices May Firm Up Soon

Lower interest rates generally improve affordability and boost demand for new projects. Developers, having held prices steady through a soft 2024–2025 cycle, may become more confident in firming up their pricing going into 2026.

What it means for you:

- Monthly repayments likely remain stable or fall.

- Buyer demand could return faster than expected.

- Popular projects may see stronger take-up.

👉 Call to Action:

If you're considering a new launch, shortlist and enter early before developers adjust prices upward. The window for early-bird units may not last.

2. Resale Buyers: The Bargain Window Is Narrowing

Resale prices often respond earlier than new-launch prices when interest rates shift. As borrowing costs stabilise, sellers may become less negotiable, especially in high-demand areas.

What it means for you:

- The best-value units will see renewed competition.

- Resale transaction volumes could pick up.

- Below-valuation deals may become rarer.

👉 Call to Action:

If you’ve been waiting to buy resale, move decisively on undervalued listings before buyer interest rises in early 2026.

3. Existing Homeowners: Prepare for Refinancing Opportunities

As SORA drifts lower, homeowners may benefit from reduced instalments and attractive refinancing packages.

What it means for you:

- Monthly mortgage payments may ease.

- Banks are likely to roll out competitive fixed and floating packages.

- Improved liquidity tends to support property values.

👉 Call to Action:

Review your mortgage. Start preparing documents early so you can lock in refinancing savings once banks revise their rates.

4. Property Investors: A New Cycle of Liquidity Is Emerging

Falling interest rates combined with QE typically lift property prices over time. While rental yields may compress slightly, lower borrowing costs and capital gains potential help offset this.

What it means for you:

- Capital appreciation opportunities may grow.

- Well-located projects could outperform.

- Additional liquidity could create a mild asset inflation cycle.

👉 Call to Action:

Investors should identify growth corridors, undervalued developments, and assets with strong rentability before liquidity-driven price momentum accelerates.

Conclusion: A New Monetary Cycle, A New Set of Opportunities

With the Fed easing policy and restarting quasi-QE, and with Singapore’s SORA remaining low, the property market may be entering a more supportive phase. Each buyer group—new-launch buyers, resale buyers, homeowners, and investors—will experience different opportunities and risks.