Thomson View En Bloc Sale Signals New Opportunities in District 20: What Owners, Buyers & Investors Should Do Next

The successful collective sale of Thomson View Condominium marks a defining moment for Singapore’s private residential market in 2025. Beyond being one of the year’s largest en bloc transactions, the deal underscores renewed developer confidence, owner resilience, and the long-term redevelopment potential of District 20.

Thomson View En Bloc Sale: Key Highlights

Thomson View was sold for S$810 million to a joint venture between UOL Group and CapitaLand Development, making it one of the most significant en bloc transactions in recent years.

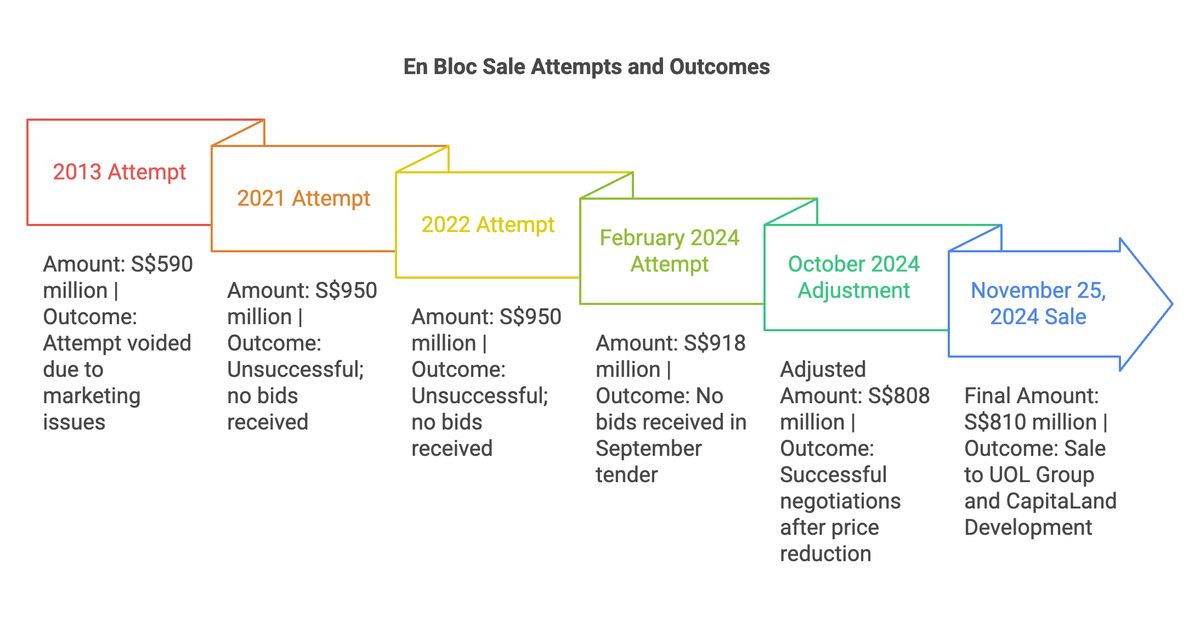

What makes this sale especially notable is its long journey—five failed collective sale attempts over nearly 20 years, with earlier reserve prices reaching S$950 million. In 2025, owners recalibrated expectations, lowering the reserve price to S$808 million, which secured approval from over 80% of owners and ultimately closed the deal.

The transaction reflects a land rate of approximately S$1,178 psf per plot ratio (psf ppr). The expansive 504,314 sq ft site is zoned residential with a 2.1 plot ratio, offering substantial redevelopment flexibility.

Why This Matters for District 20

The redevelopment of Thomson View is expected to reshape the Thomson area in several meaningful ways:

- New Housing Supply: The site may yield up to 1,240 new residential units, helping to alleviate pent-up demand in District 20, where new launches have been limited.

- Modern Living Standards: A new-generation development will likely introduce upgraded facilities, greener design, and family-centric layouts aligned with current buyer preferences.

- Economic Spillover: Construction activity and future population growth will support nearby businesses, services, and amenities.

Market Outlook: Demand Likely to Be Strong

With its proximity to established schools, amenities, and transport connectivity, the redeveloped Thomson View site is well-positioned to attract both owner-occupiers and investors. Against the backdrop of stabilising interest rates and limited land supply in mature estates, market watchers expect healthy take-up once the new project launches.

Should Existing Thomson View Owners Reinvest in the New Project?

Former owners are in a unique position following the en bloc sale and may wish to consider buying into the upcoming development.

Key considerations include:

- Capital Upside: A brand-new project with modern specifications typically commands stronger long-term appreciation than ageing developments.

- Familiar Location, Better Living: Owners can remain in a neighbourhood they value while upgrading to a contemporary living environment.

- Strategic Reinvestment: For those reallocating en bloc proceeds, reinvesting early in a high-demand redevelopment may offer a favourable risk–reward balance.

Updated Call to Action (CTA)

- For former Thomson View owners:

👉 Plan early. Evaluate whether reinvesting part of your en bloc proceeds into the new development aligns with your lifestyle or portfolio goals. - For homebuyers:

👉 Watch this site closely. Large-scale redevelopments in mature estates are rare and often sell quickly upon launch. - For investors:

👉 Position ahead of launch. New projects in land-scarce, established districts often benefit from both rental demand and capital appreciation.

Conclusion

The Thomson View en bloc sale is more than a successful transaction—it is a signal that well-located, large land parcels in mature estates remain highly sought after. As redevelopment plans unfold, opportunities will emerge for homeowners, upgraders, and investors who are prepared to act early and strategically.

汤申景苑集体出售成功:第20区重建机遇浮现,屋主与买家下一步该怎么走?

汤申景苑(Thomson View Condominium) 的成功集体出售,成为2025年新加坡房地产市场的重要里程碑。这不仅显示发展商信心回暖,也突显成熟地段大型重建项目的长期价值。

汤申景苑以 8.1亿新元 成交,由 UOL集团与凯德发展(CapitaLand Development) 联合收购。这宗交易经历了近20年、五次失败尝试,最终在屋主将保留价下调至 8.08亿新元,并获得超过 80%屋主同意 后成功落实。

该地块约 50万平方英尺,住宅用途,容积率 2.1,成交地价约 每容积平方英尺1,178新元(psf ppr),具备高度重建潜力。

预计新项目可提供多达 1,240个住宅单位,为近年新盘稀缺的第20区注入新供应,并提升整体居住环境与区域活力。

给屋主与买家的行动建议(CTA)

- 原屋主: 提早规划是否回购新项目,实现资产升级

- 自住买家: 关注成熟区稀缺新盘,抢占入场时机

- 投资者: 在项目推出前做好布局,争取先发优势

如果你需要,我可以:

- 将内容改写为 开发商发布稿 / EDM / LinkedIn文章

- 加入 价格对比、潜在回报分析

- 针对 原屋主或投资者 做更精准的CTA版本